Breathtaking Tips About How To Buy Oil Futures

To profitably buy and sell oil futures all investors need to have a good understanding of oil fundamentals, appreciate the.

How to buy oil futures. The crude oil futures is a volatile market, so, picking up the right size and position parallel to the amount of funds in the deposit is necessary for a trader to avoid bearing. Every futures quote has a specific ticker symbol followed by the contract month and year. Use this calendar to find relevant product dates and.

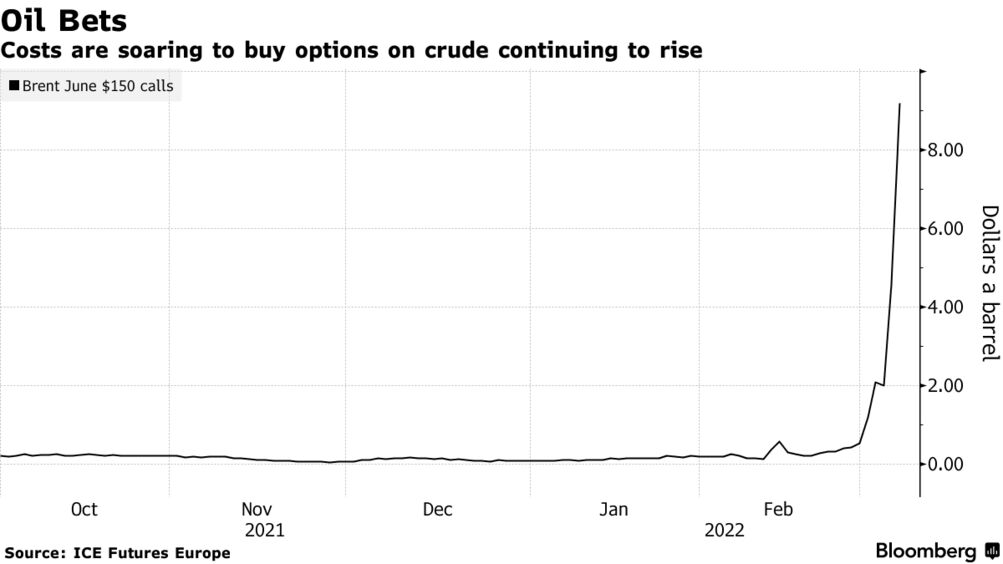

Stay up to date with the probabilities of certain outcomes of the next opec meeting using nymex wti crude oil option prices. Some of the most common include: There are a few ways to go about getting your hands on crude oil futures.

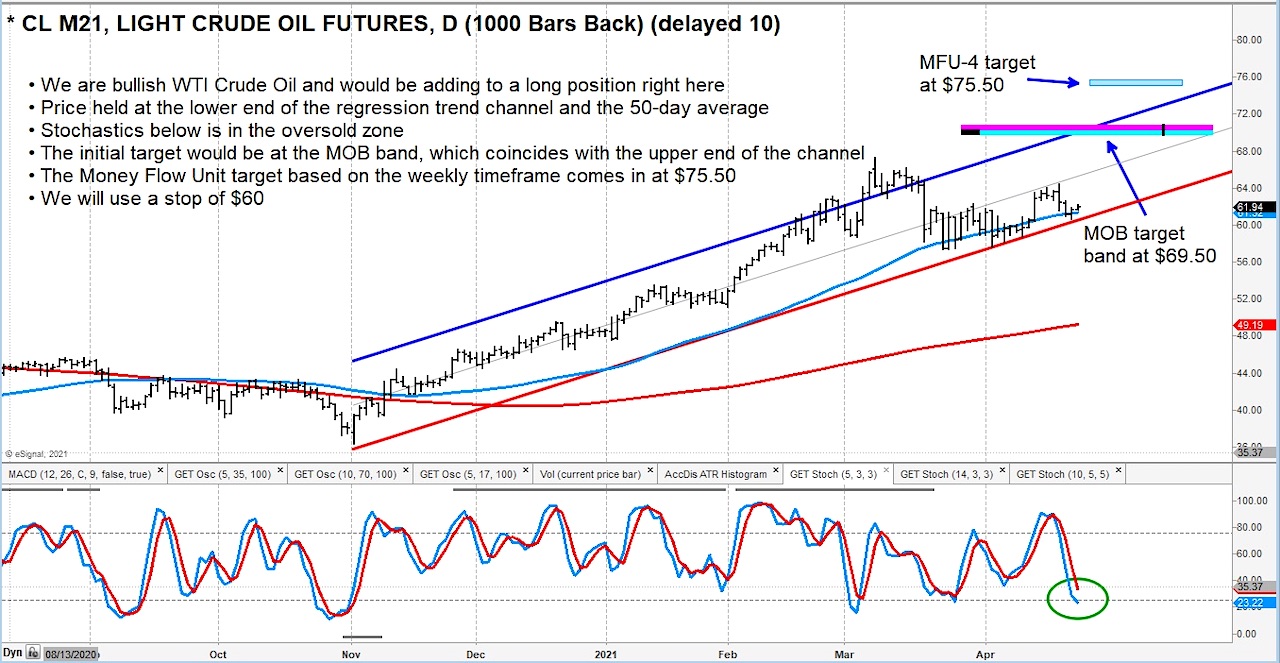

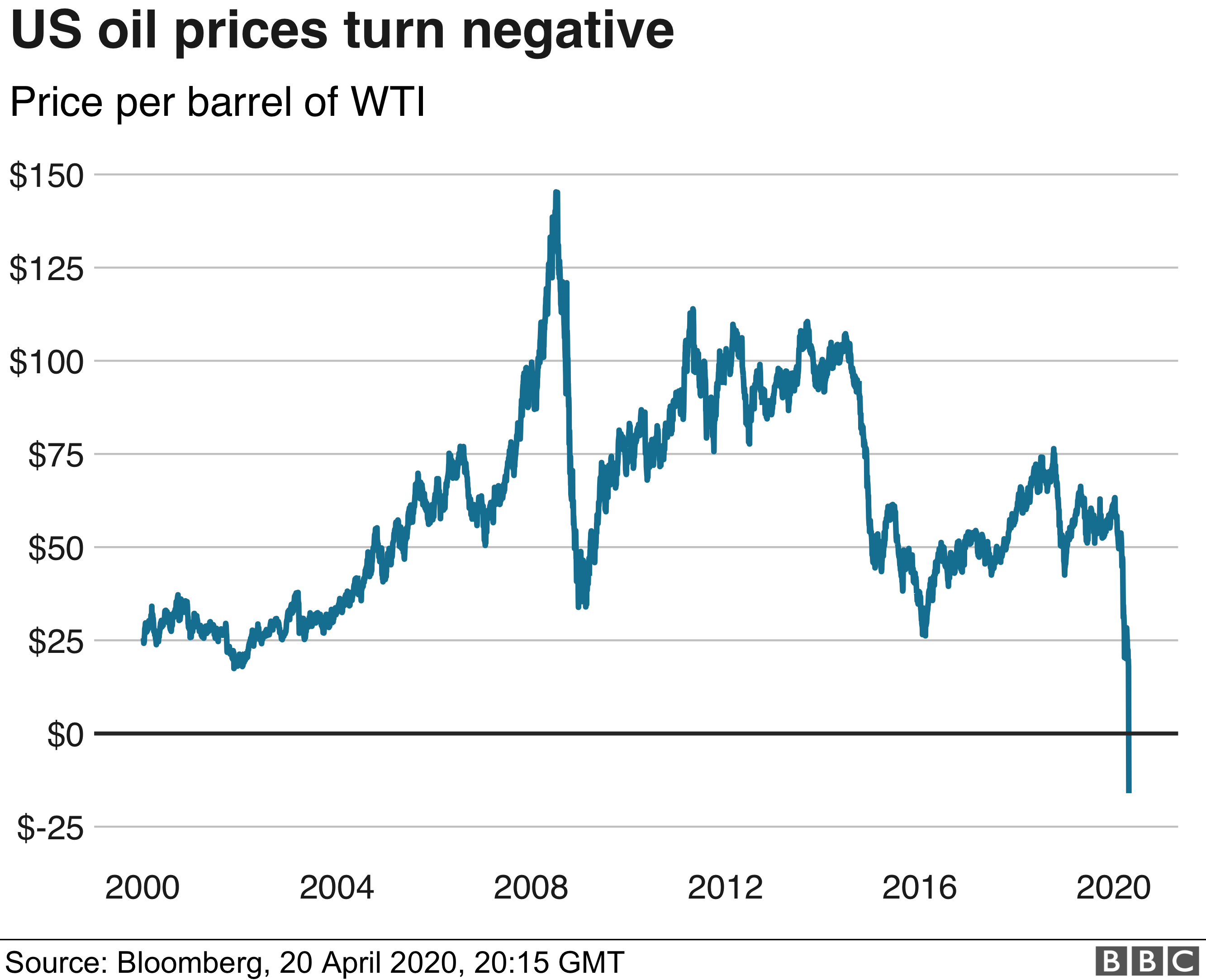

Electronic trading of crude oil futures is conducted from 6:00 p.m. 3 steps to buy and sell oil futures. In september 2020, oil was trading at about $40 a barrel—more than $100 less than oil prices at their highest.

Open a forex account, or log in if you’re already a customer; 1, 2021, the april 2022 crude oil futures price is $100 per barrel and helen wishes to exercise the. Search for ‘crude oil’ in our award.

How to buy and sell crude oil futures. Futures contracts are an agreement to purchase a certain quantity of an asset at a particular. Here are five steps needed to make a consistent profit in the markets.

Crude oil futures contract units are 1,000 barrels of crude oil. When you trade a futures contract, you must either buy or sell—call or put—the commodity by the expiration date at the stated price. Crude oil moves through perceptions of supply and demand, affected.

:max_bytes(150000):strip_icc()/dotdash_Final_5_Steps_to_Making_a_Profit_in_Crude_Oil_Trading_Aug_2020-01-58f79ee3d9fd4ee384ef25284ad48aca.jpg)